| Home | Products | Services** | Purchase | Support | Special Offers |

Prompt Family Law Superannuation Valuations

High quality, prompt and cost efficient family law superannuation interest valuations |

Who we are

We have been providing family law superannuation valuations using our specialist software since 2003. We efficiently provide valuations for 'normal' funds as well as funds with approvals for special methods/factors such as the ones listed below.

Please note that we have a new website here.

Why brief us - how we are different

|

|

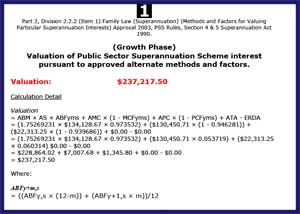

Example Valuation Reports

The following sample reports show the format and high level of attention and detail that we provide.

Valuation Prices

Solicitors need to contact us for a quote or we can provide a link that can be used to self-serve costs.

Specially-approved funds that we handle in addition to normal ones.

| Name | Sector |

| Commonwealth Superannuation Scheme (CSS) (Cwlth) | Commonwealth Public Sector |

| Public Sector Superannuation Scheme (PSS) (Cwlth) | Commonwealth Public Sector |

| Military Superannuation and Benefits Scheme (Cwlth) | Commonwealth Public Sector |

| Defence Force Retirement and Death Benefits Scheme (Cwlth) | Commonwealth Public Sector |

| UniSuper | Other |

| Defence Force Productivity Benefit Scheme | Commonwealth Public Sector |

| Benefits provided under the Superannuation Benefits Act 1977 (Vic) | Victorian Public Sector |

| Ford Employees Superannuation Fund | Other/Private/Ford |

| Ford Management Retirement Plan | Other/Private/Ford |

| Gold State Super Scheme (WA) | Western Australian Public Sector |

| Parliamentary Contributory Superannuation Scheme (Cwlth) | Commonwealth Public Sector |

| State Superannuation Act 1988 [New Scheme] (Vic) | Victorian Public Sector |

| Superannuation scheme established by the State Superannuation Act 1988 (Vic) - revised scheme members | Victorian Public Sector |

| Victorian Racing Industry Super. Fund | Other/Private |

| Victorian State Employees Retirement Benefits Scheme | Victorian Public Sector |

| Victorian Transport Superannuation Fund (Vic) | Victorian Public Sector |

Payment options

To make life as easy as possible for you and your clients we offer a wide range of payment options, and a substantial discount for paying 'up-front' by MC Visa or direct deposit. We don't impose a surcharge for credit card payments. |

|

Clients/Direct Briefing

Although most of our clients are solicitors we do also accept direct briefs from the public.

Availability and Turnaround

- Turnaround is within one week of final instructions, or if needed, faster by arrangement.

- All other things being equal, we process valuations in order of payment.

- We are ready to accept your instructions now.

Briefing procedure

- Complete the standard Form 6 (or equivalent for special funds - see links below) and submit it to the relevant fund. Specify the relevant date(s) carefully. Contacts and links to forms (eg the Commonwealth's SmartForm) for common funds are provided below.

- We recommend that you obtain a benefit (pay-out) estimate at the same time.

- When you receive the Trustee's response, fax or email it and your instructions to us.

You are also welcome to telephone. Contact details:

Tel. Brisbane: (07) 31 247 147

Tel. Sydney: (02) 89 167 407

Tel. Melbourne: (03) 83 999 407

National Fax: (07) 3102 9272

Eml: See Contacts Page

Web: www.lawtech.com.auLawtech (Aust) Pty Ltd

PO Box 2250

New Farm Qld 4005

ABN 76 070 802 121 - We will check your instructions for completeness and email you confirmation plus a tax invoice. If you have asked for a quote, or the fee differs from the prices shown or previously advised then we will await your instructions to proceed, otherwise we will proceed automatically.

- We will calculate the valuation and prepare a draft report.

- We will email you when the draft report is ready to download from your account area.

- Automatically after a specified time, or upon your instructions, we will then produce the final signed report and make it available for download. It will append all the source documents as part of the report.

- If you opted for a bound colour printed spiral-bound hard copy then we will send that to you by Express Post.