Features

Calin Professional Lite V5 handles a very wide range of legislative and contractual scenarios.

Availability:

|

Calculate interest on multiple transactions

Calin Professional Lite V5 handles situations that involve involve more than one debt and/or payment.

Example scenarios

- Bank and credit card statements

- Lease and loan instalments and payments

- Store accounts and revolving credit accounts

- Professional firm's monthly invoices to, and payments from, clients

Calin handles these situations easily, and adds these refinements:

- Particular transactions can be labeled as being not subject to interest

- Particular transactions can have different due dates - eg 14 days to pay

- Provides a tool lets you enter recurring amounts such as lease payments instantly. Recurring transactions tool

- When calculating interest on a lease or loan you can automatically insert each event

Specify order of applying payments

Calin Professional Lite V5 allows you to specify the order in which payments are applied.

When you are calculating interest involving multiple transactions - i.e. more than one debt and/or payment, the result can be significantly affected by the order in which payments are applied.

Calin provides you with the ability to easily select a method of applying payments that suits your situation:

- Lowest Interest - this will select the payment allocation order that will result in the lowest total interest.

- Highest Interest - this will select the payment allocation order that will result in the highest total interest.

- Manually Configure - this lets you choose the exact order you require to comply with contract or legislation.

Use a variety of interest rate styles

You can select from five types on interest rates.

- Static Rate - a simple rate such as 7.5%

- Stored Variable Rate - accommodate any number of rate changes, and the rates can change according to amount as well as date. These can be created and reused - *or one of the subscription rates if applicable to your edition.*

- Custom Rates - have all the sane characteristics as a Stored Variable Rate - except that you don't save the rates in a separate reusable file. Instead, the rates are stored as part of the calculation. You can use this for ad hoc calculations that need tiered interest rates but won't be needed on a regular basis.

Apply rates on credit balances

If required you can specify a different regime of interest rates for where an account balance is in Credit instead of Debit. By default the rate for interest on Credit balances is "Same as Debits".

Apply moratorium interest rates

Moratorium rates are used to override the interest rate that would otherwise apply. You can use this to reduce the interest rate on hardship grounds - eg during a period of illness, or you can simply use it to modify the prevailing rate on any other ground. Calin lets you override the rate for any number of date-spans that you define.

Adjust nominal interest rate

You can adjust the nominal rate by a percentage or multiplier. This is perfect for 'overdraft-rate plus n%' situations because you don't have to create a secondary Stored Variable Rate file, or perform the adjustment manually.

Control when rates change

When you use Stored Variable Rates or Custom Rates which specify interest rates that change from time to time, the default assumption is that every time the underlying rate changes, the calculation should adopt the new rate immediately on and from that date. However there are occasions where that is not good enough. For example the applicable interest rate might be linked to some frequently-changing government rate, and yet in the particular situation, the rate is only allowed to change once or twice a year. Calin accommodates a variety of different options. And can even accommodate systems such as USA Federal where the calculate rate-date has to be further adjusted.

Control when interest accrues

You have full control over when interest is accrued. You can make interest accrue periodically, or at the end of each month, or according to other options as shown here which allow you can match contractual and legislative rules exactly.

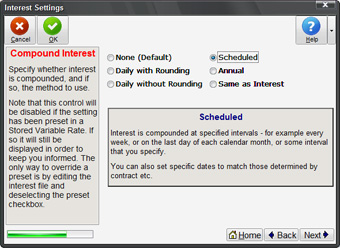

Control when compound interest as applied and on what

Calin easy handles compound interest. You can choose form six different compounding options here.

- Daily with Rounding Interest -will be compounded once per day. Mathematically, this will usually resolve to a decimal fraction such as $0.95.434344378 cents. Rounding means that interest will be rounded every day to the smallest monetary unit - eg $0.95 cents. The purpose of this is to make the calculation easier to follow.

- Daily without Rounding Interest - will be compounded once per day but decimal-fractions will not be rounded to the smallest monetary unit (eg cents).

- Scheduled - this gives you the same scheduling powers as for normal Interest.

- Annual - interest will be compounded on the annual anniversary of the calculation's start date.

- Same as Interest - interest will be compounded every time interest accrues - whether daily or some other interval.

- None - No compounding occurs.

Finance Calculations

- Loan Calculation. Enter the amount to borrow and the terms of the loan to see what the cost of finance will be.

- Mortgage Schedule. Calculate the cost of a mortgage and produce a schedule which shows the principal and interest component of each instalment.

Other Options and Settings

Calin gives you the option to control these other settings as well, though in most cases you would just stick to the default settings. Round the daily interest rate up or down. This is for compliance with contracts and legislation which prescribe rounding rules. Minimum/Maximum Rates. This is for compliance with contracts and legislation which prescribe minimum/maximum rates of interest. It lets you use an underlying Stored Variable Rates file containing constantly varying rates, but without the worry that you will incorrectly/illegally exceed the allowable limits.

Calculate repayment plans that take into account ongoing interest calculations

Calculate the amount and frequency of payments needed to reduce a debt to zero or other figure by a nominated date. Alternatively calculate how long a specified rate of payment will take to reduce a debt to zero or other amount. You can be pro-active with debt management for your business or clients. You can create repayment proposals based on flexible parameters and the debtors pay days. Complex calculations are performed effortlessly and with perfect accuracy. Avoid typing by printing repayment schedules ready for you to attach to letters and agreements. Scare debtors by showing them the effect of interest over time.

Show all your calculation details

Not only calculate interest but produce a report detailing how the result was obtained. This can be used in documents to verify the accuracy of the calculation and/or can be used to comply with court rules that require particulars of interest calculations.

Step-by-step Interface

Calin Professional Lite V5 has a step-by-step interface which guides you through the calculation one step at a time. There is also a 'Scenario' menu at the start which further simplifies the process by hiding unnecessary screens and pre-completing others.

Unlimited maintenance updates

Because Calin Professional Lite V5 is intended for serious professional and business use, the licence is for a defined period during which you are entitled to every maintenance update, feature additions and even entirely new versions. The program checks for updates whenever it starts and lets you know if a newer version is available. A single user licence also generously includes the right to install a copy on your office PC, plus your personal-assistant's PC, plus your home PC or laptop at no extra cost.

Calin Pro LiteThe Standard Edition of Calin Professional Lite V5 has a very rich set of tools and can handle a very wide range of legislative and contractual scenarios.  Calculating interest on Inter-Entity Loans (between Directors/Companies and Partners etc) Calculating interest on Inter-Entity Loans (between Directors/Companies and Partners etc)

Calculating interest on your own firm's overdue fees Calculating interest on your own firm's overdue fees

Calin Professional V5 (Full Edition)There are several full editions. They generally include interest rate subscriptions, advanced multiple-phase interest, and other tools depending on the edition. |

Looking for an online solution?If you would like an online solution that will enable you to perform the same sorts of calculations as Calin Basic and more, take a look at Calin Online Interest Calculator. Not quite what you are looking for?If you would like software for your computer that will enable you to perform less advanced calculations, take a look at Calin Basic Lite Interest Calculator. For more sophisticated requirements click the Comparison chart icon at right. |