Features

|

Calin Online Interest Calculator provides quick and professional solutions to a common need felt almost daily by every litigation, commercial and accounts department within the legal profession and business organizations

|

Calculate interest instantly

Simply enter the principal amount, the start and end dates of the period, apply the rate and your calculation will be done. You control whether the interest is compounded, and what interest rate or interest rate schedule is applied.

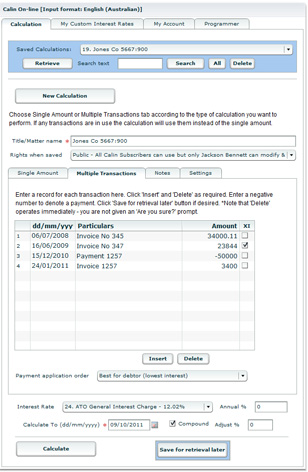

Calculate interest on multiple transactions

Enter debit and credit transactions, when they occurred, and how much, apply the rate and your calculation will be done.

Apply interest rate schedules

Enter your principal amount or transactions, select a supplied interest rate schedule or create your own.

Create your own shareable, reusable interest rate schedules

You don't have to remember when the rates changed or what the rates were. Store rates that change from time to time, such as court rates and finance rates, allowing you to automatically apply the correct date-dependant interest rate. You simply choose the rates from a convenient menu. You can update the files at anytime, or make new ones. For instance you can store all the Federal Court interest rates in a file. Whenever you have a Federal Court case, simply specify that file and the appropriate rate will be applied.

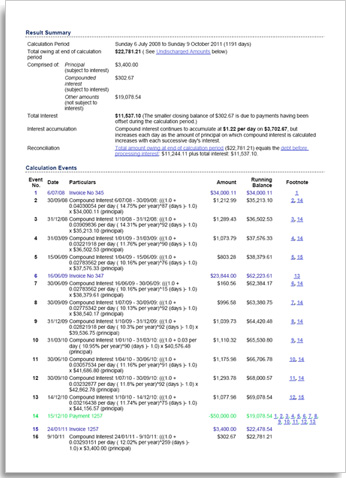

Show all your calculation details

Not only calculate interest but produce a report detailing how the result was obtained. This can be used in documents to verify the accuracy of the calculation and/or can be used to comply with court rules that require particulars of interest calculations.

Print professional reports

Calculation schedules can be previewed on screen and saved as a PDF document. Printed calculation schedules are well designed and ready to attach to reports, letters and court documents. They are produced instantly and with perfect accuracy, saving you time, stress, money & effort.

Have your calculations available wherever you go

You can save your calculations to be retreived at a later date and Calin Online Interest Calculator is available wherever you have access to the internet.

Calculate and recover interest on your client and business agreements

Make money by recovering interest instead of waiving it because of the difficulty calculating interest. For instance, if your own contracts stipulate a term such as "interest at XYZ Bank prime lending rate + 2%" then calculations are complex because rates change frequently. Calin Online Interest Calculator calculates it for you instantly, ready for your Accounts Department to recover.

Save your time and your mind

You don't have to work out for yourself the number of days between dates, or remember interest rates as at particular dates. No longer worry about making mistakes. You don't have to type details of the calculation or how you produced the result. All is done for you.

Can be used for all English-speaking, decimal based currency calculations

Calin Online Interest Calculator is suitable for all English-speaking, decimal based currencies, eg AUD, CAD, Euro, HKD, NZD, PGK, USD.

After something that can perform more complex interest calculations?Take a look at Calin Professional Interest Calculator. This software is particularly valuable in the following scenarios:

Still not quite what you are looking for?If you would like software for your computer that will enable you to perform less advanced calculations, take a look at CALIN Basic. |